Cool Hot Tubs for Summer Fun

Thu, 30 JulNo need to go on vacation to enjoy the summer. Bring the fun home with these amazing hot tubs!

No need to go on vacation to enjoy the summer. Bring the fun home with these amazing hot tubs!

Calgary’s Summer Festival Scene rivals any other, with performers and artists embarking on our city each year to put on a great time. It wouldn’t be summer without checking out at least a couple of the events, and the sites, sounds and culinary adventures they have to offer.

Calgary Folk Music Festival July 23rd-26th

Revel in one of the ‘7 musical wonders of the world’ (Globe and Mail) at Prince’s Island Park. 76 artists from 16 countries on 8 stages in concerts and magical collaborative sessions. This year’s newcomers and mainstays include Jr. Gone Wild, Father John Misty, Esperanza Spalding, Buffy Sainte-Marie , Lucinda Willams and the Mavericks.

Afrikadey! 2015 World Music Festival Aug 5th – Aug 8th

A week-long celebration of the music, food, dance, theatre, film, literature and visual arts of Africa and her descendant cultures. These events take place at different venues all over the city with a final day of music on Prince’s Island.

Marda Gras Street Festival Aug 9th

Thousands of locals embark on a decorated Marda Loop to experience the culture and cuisine of New Orleans in a free, outdoor festival. With a kid’s zone, an entertainment stage with an eclectic line-up and local food vendors, this street party does not disappoint.

GlobalFest August 20th to 29th

Within GlobalFest is the OneWorld Festival, the Firework’s Festival, the Night Market and hundreds of thousands of people of different cultures coming together to celebrate the cultural diversity within Calgary’s communities. Cultural pavilions and countries present pyromusicals nightly in Elliston Park.

Carifest Aug 22nd

Calgary’s Carifest is a celebration of Caribbean culture. Immerse yourself in the culture by attending events such as gospel concerts, movie nights, cultural showcases, and parades. Plus the Sunshine Fest, which kicks off Carifest with music, food, and entertainment at Shaw Millennium Park.

There are many costs associated with buying your first home or your dream home. There are upfront costs and ongoing costs that you need to consider when planning your home-buying budget.

Upfront costs may include:

– Down Payment – This needs to be ready at time of purchase and its source to be verifiable by the bank.

– Initial and Additional Deposits – This is part of your down payment and has to be accessible when you’re placing an offer on a property.

– Home Inspection – Costs of a home inspection runs from $350 to $550 on average, but it can go up to $1500 for larger homes, acreages, and specialty houses.

– Condominium document reviews – When buying condo, having an independent professional to review your documents is really important. Costs vary from $350 to $550.

– Appraisal fees – This cost may be paid by the lender or bank, but in some cases you have to pay the cost again. Costs are between $250 and $550 and up for specialty homes.

– Mortgage Insurance fees – CMHC & Genworth fees are for mortgages with downpayments less 20%. This fee is added to your mortgage. You broker will advise you on the amount.

– Legal fees and disbursement – Legal fees vary from $1,200 to $1,500 and more. Fees are based on the price of the home and the size of your mortgage.

– Moving Costs – This is a hard one to estimate. It can range from a few hundred dollars by just renting a U-Haul to a few thousands by hiring professional movers.

Ongoing costs may include:

– Your Mortgage Payments – This can be in monthly, bi-weekly or weekly terms. The more frequent your payment is, the faster you are paying off your mortgage.

– Home insurance – Home insurance is based on the size of the house and several other factors.

Other regular fees include Property Taxes, Condo Fees, Utilities, Repairs and Maintenance.

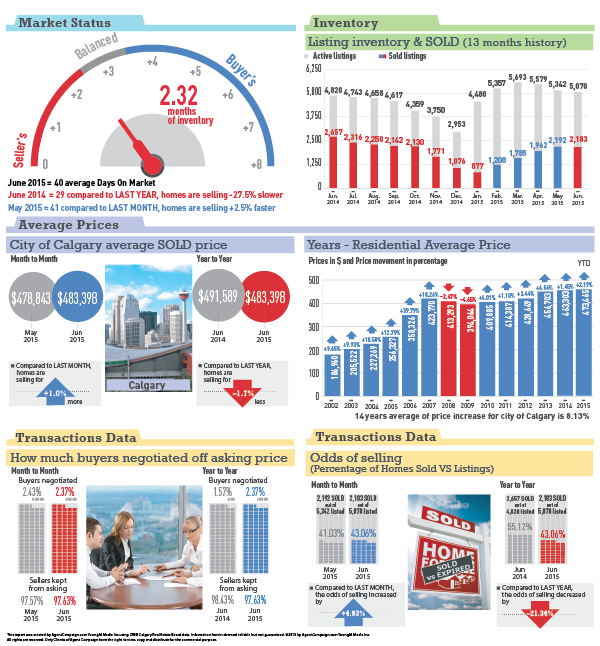

June sales consistent with typical levels

Calgary inventory levels ease

Despite the 18 per cent year-over-year decline in June home sales, for a total of 2,183 units, transaction levels remain only five per cent below the 10 year average for June and three per cent above levels over the past five years.

“We’ve seen less concern from consumers lately,” said CREB® president Corinne Lyall. “One of the main reasons is that we haven’t seen the worst case scenarios play out in the energy and housing sectors.”

“Consumers who were waiting for wide-spread price declines have been surprised to see that it just hasn’t happened yet, and so they’ve decided to take advantage of the improved selection and lower lending rates,” said Lyall.

The level of new listings that came on the market in June totaled 3,122 units, resulting in the second month of elevated absorption rates, which placed downward pressure on inventory levels. The overall months of supply continues to remain balanced at 2.3 months.

With conditions remaining relatively stable in June, there was minimal pressure on home prices. The city-wide benchmark price totaled $455,400, a respective monthly and year-over-year gain of 0.29 and 0.13 per cent.

“Even though city-wide prices were essentially unchanged in June, it’s important to note that activity can vary significantly depending on community, property type and price range,” said Lyall. “Every transaction has its own unique features, which is why we always encourage consumers to discuss these differences with local experts.”

Second quarter results pointed towards more stability in the market. The year-over-year decline in sales activity eased from 32 per cent in the first quarter to 22 per cent in the second quarter. Meanwhile, the level of pullback of new listings outweighed the gains recorded in the first quarter, resulting in a year-to-date decline of nearly eight per cent.

While both sales and new listings have slowed for each property type within the city, the apartment sector continues to report the weakest absorption rates.

The weaker rates in this sector are now impacting prices. Despite last month’s improvement in price, the second quarter benchmark price was 0.81 per cent below levels recorded last year and 0.93 per cent below first quarter figures. Year-to-date unadjusted apartment averages continue to remain 1.65 per cent above last year’s levels.

In the detached segment, benchmark prices totaled $515,500 in June, slightly higher than last month and 0.4 per cent higher than June 2014 prices. Meanwhile, the year-to-date benchmark price for detached properties remained 3.44 per cent above last year’s figures.

Against this backdrop, the year-to-date average and median detached home price for Calgary has reported declines of 2.26 and 1.54 per cent city-wide. This doesn’t come as a surprise, given that the share of sales activity has declined in the higher price ranges.

“The housing market is showing some signs of stability right now,” said CREB® chief economist Ann-Marie Lurie. “However, there are several risk factors that could influence the market in the second half of the year,” said Lurie. “Many of these factors will be addressed in CREB®’s mid-year forecast update, which will be released at the end of July.”